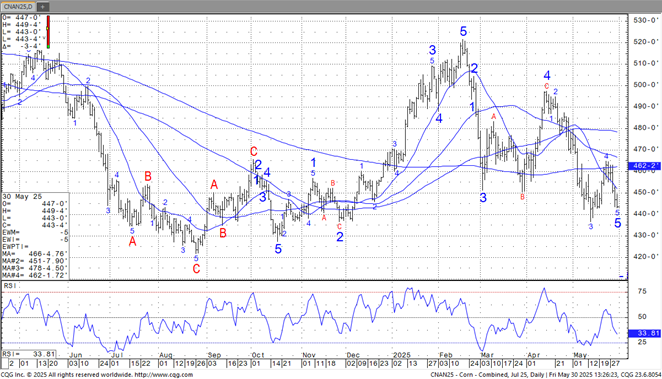

CORN

Corn futures ended down 2 cents and near 4.44. Weekly US corn export sales were 916 mt and near the lower end of trade estimate. Total commit is near 64.1 mmt vs 50.0 ly. USDA goal is 66.0 mmt vs 58.2 ly. USDA estimates total World 2024/25 corn exports at 189.3 mmt vs 193.5 ly. USDA est China imports at 8.0 mmt vs 23.4 ly. USDA announced 145,560 mt US corn to unknown and 65 mt 25/26 also to unknown. NOAA est that 23 pct of US corn area is in drought vs 22 last week and 4 ly. Weekly ethanol production was up 1.9 pct vs last week, Stocks were down 2.7 pct vs last week. Safras est Brazil corn crop at 139 mmt, a record and vs USDA 130.

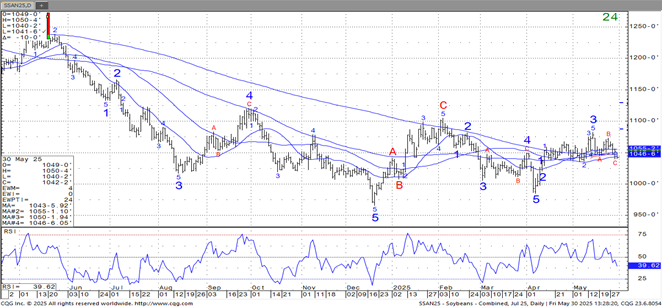

SOYBEANS

Soybean futures ended lower with SN near10.41. Soyoil is lower on delay in RVO policy. March soyoil use for biofuel was 194 mil lbs less than last year. Soymeal is slightly below 300 supported by soymeal/soyoil spreading. World soymeal basis levels are sharply lower on too much supply. Weekly US soybean export sales were 146 mt and at the lower end of trade estimate. Total commit is near 48.4 mmt vs 43.2 ly. USDA goal is 50.3 mmt vs 46.1 ly. USDA estimates total World 2024/25 soybean exports at 180.7 mmt vs 177.6 ly. USDA est China imports at 108.0 mmt vs 112.0 ly. China Oct-Apr soybean imports were 46.3 mmt vs 54.5 ly. NOAA est that 17 pct of US soybean area is in drought vs 16 last week and 2 ly. April US NOPA soybean crush is est at 201.8 mil bu vs 177.6 ly.

WHEAT

WN is near 5.33 in mostly range bound trade. Weekly US old crop wheat export sales were down 128 mt. Total commit is near 21.3 mmt vs 18.8 ly. USDA goal is 22.3 mmt vs 19.2 ly. USDA estimates total World 2024/25 wheat exports at 205.1 mmt vs 221.1 ly. New crop sales were 711 mt. USDA est US 2025/26 wheat exports at 21.7 mmt and World exports at 213.0 mmt. NOAA est that 29 pct of US spring wheat area is in drought vs 29 last week and 3 ly. Heavy rains are forecast for E KS, E OK, MO, S IL, S IN, W KY and W TN. France and Russia wheat areas need a rain. China wheat area remains dry with China trying to seed clouds to trigger rains.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.