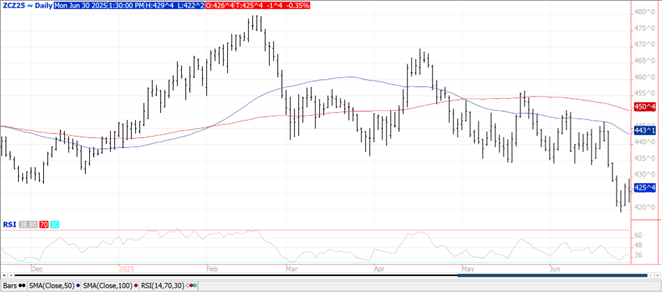

CORN

Prices ranged from $.03 higher in July-25 to a $.02 lower in new crop. No deliveries against the July contract provided support. Dec-25 closed about midrange in choppy 2 sided trade. US weather remains mostly favorable for crop development. Extended forecasts into mid-July continue to suggest temperatures and precipitation above normal for much of the nation’s midsection. June 1st stocks 4.644 bil. bu. were down 7% YA and in line with expectations. Inventories divided by the 1st 3 quarters implied usage ratio at 38.7% is down from 42.6% YA however still the 2nd highest in the past 5 years. Corn acres at 95.203 mil. were down 123k from March intentions, 150k below expectations. Despite the reduction acres are still the highest in 12 years. Acres were down 300k in NE, 200k in KS, 150k in TX, 100k in IL and MN. Acres were up 100k MI, MO and SD. Friday’s CFTC report showed MM’s were net buyers of a couple thousand contracts of corn in the week ended last Tues. June 24th reducing their short position to 182k contracts. Index funds however sold another 9k contracts.

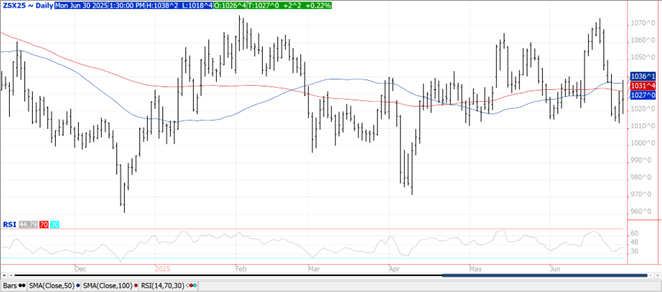

SOYBEANS

Prices ranged from $.03 ½ lower in old crop to $.03 higher in new corp. Both products finished slightly higher. Bean oil deliveries were lite at only 7 contracts while 200 contracts for beans and 643 against the meal. Meal spreads traded out to new lows. Near complete dryness for SA this week. Favorable for corn harvest in both Brazil and Argentina. Following heavy weekend rains a precipitation break is welcome in S. Brazil. Extreme heat and dryness will continue for W. Europe thru midweek. Cooler temperature the 2nd half of the week will be welcome, however rains to remain scattered over the next 7 days. June 1st stocks at 1.008 bil. were up 4% from YA, 28 mil. above expectations. Soybean inventories divided by the 1st 3 quarters implied usage ratio at 27.2% is down slightly from the 27.9% YA however still the 2nd highest in the past 5 years. June acres at 83.380 mil. were down 115k from March intentions and 275k below expectations. Planted acres were down 200k in IN, MS and OH while up 400k in ND, 150k WI, 100k in KS and SD. The sell-off in meal has stimulated some demand with the USDA announcing the sale of 204k tons to an unknown buyer for the 2025/26 MY. Combined biodiesel and RD production fell 4% in April to 354 mil. gallons and down 16% YOY. Bean oil usage however was down less than 1% to 829 mil. lbs. Soybean oil represented 31.6% of the feedstocks used in green fuel production, the highest in 4 months. MM’s were net sellers across the soy complex. They sold nearly 36k contracts of beans slashing their long position to only 23k contracts.

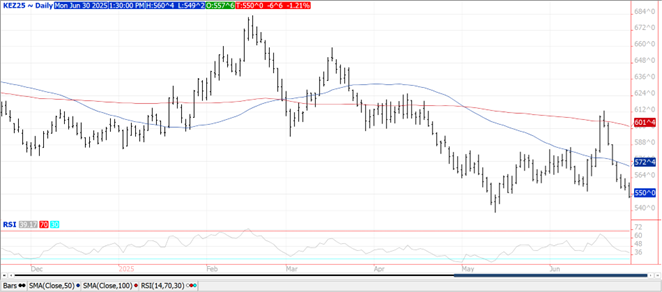

WHEAT

Prices were sharply mixed ranging from $.04 higher in July-25 CGO to $.10 lower in KC July-25. Deliveries against CGO futures were light at only 10 contracts while much heavier for KC at 315 contracts. KC spreads widened out to new lows. June 1st stocks at 851 mil., were well above 696 mil. from YA, 14 mil. above expectations. All Wheat acres at 45.478 mil. were up 128k from March intentions, however in line with expectations. Winter wheat acres at 33.325 mil. were up 10k from March, slightly above expectations however harvested acres were cut 888k to 24.83 mil. Largest cuts were in TX down 450k and KS down 200k. Spring wheat acres up 25k from March, durum up 93k from March. MM’s were net buyers across all 3 classes of wheat slashing their combined short position to 108k contracts, well off the record short of 235k contracts just 6 weeks ago.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.