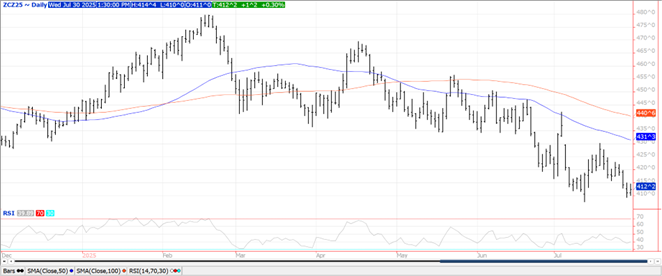

CORN

Prices were $.01-$.02 ½ higher in choppy 2 sided trade. Spreads also bounced. Both Sept-25 and Dec-25 traded within yesterday’s range. Near term support for Dec-25 rests at its contract low at $4.07 ½. The Midwest is seeing relief from the recent heat and humidity as heavy rains moved across NE and Iowa overnight. As this system shifts east healthy rains have spread across N. IL today and the rest of the Great Lakes region tomorrow. Ethanol production ticked up to 322 mil. gallons LW, up from 317 mil. the previous week, however down 1% YOY. Production has been at or above the pace needed to reach the USDA corn usage est. for a 9th consecutive week. There was 109 mil. bu. of corn used in the production process, or 15.6 mil. bu. per day, above the 15.23 needed to reach the USDA forecast of 5.50 bil. Ethanol stocks jumped to 24.7 mil. barrels, within the range of expectations and however above the 24.0 mb from YA and the highest in 6 weeks. Implied gasoline usage rose 2.1% to 9.152 tbd, however was down 1% YOY. Price action for December corn has been rather balanced in the month of August in recent history, since 2020 it has been higher 3 years while lower in 2 years. This followed 6 consecutive years where prices were lower for the month. Export sales tomorrow are expected to range from 32-90 mil. bu. for both old and new crop MY’s.

SOYBEANS

Prices were lower across the complex with soybean and oil making fresh session lows near the close. Beans were down $.14, meal was off $1-$2 while oil fell 67-100 points. Bean spreads were steady to lower while meal spreads rebounded. Crazy late day volatility in Aug-25 oil ahead of FND as spreads plunged in late trade. Aug-25 beans slipped to a fresh 7 month low barely holding above support at its CL at $9.64. Nov-25 beans fell to a fresh 3 ½ month low. Next support is the April low at $9.71 ¼. Fresh 21 month high for spot soybean oil overnight. New CL and fresh 9 year low for spot meal. Next support for the spot contract is $255.70, the low from Feb-2016. The soybean complex continues to shed weather premium as US forecasts remain non-threatening thru the first week to 10 days of Aug. The strengthening US dollar also added to the bearish sentiment. The US $$$ index surged to a 2 month high following the stronger than expected US GDP report that showed 2nd Qtr. growth at 3%, above expectations of +2.4% and well above the -.5% from Q1. The advanced chain-weight price index rose 2% vs. expectations of up 2.3%. The Fed. Reserve as widely expected held Fed Funds unchanged in a 4.25%-4.5% range, which will likely draw criticism from Pres. Trump who’s been demanding lower rates. Spot board crush margins closed steady at $2.27 bu., with bean oil PV slipping back to 52%. New crop margins improved $.02 to $2.25 ½ bu. In addition to export sales tomorrow the EIA will release its monthly report on biodiesel and RD production, capacity and feedstock usage. After the close on Fri. will be the monthly census soybean and grain crush data from June. History shows Nov-25 soybean have closed lower in the month of August 9 of the past 15 years. Export sales tomorrow are expected to range from 10-30 mil. bu. of soybeans, 200-500k tons of meal and 0-20k tons of bean oil. Lack of a trade deal with China and a weather problem here in the US will likely keep the path of least resistance for soybeans and meal to the downside. The recent surge in soybean oil is overdue a pause or correction as biofuel margins have tightened considerably.

WHEAT

Prices ranged from $.06 lower in CGO to up $.02-$.03 in both KC and MIAX futures. Sept-25 CGO futures have dipped to 2 ½ month lows with next support at the contract low of $5.21 ¼. Inside trade for spot KC as it again held support at its CL of $5.15. Despite the higher close, spot MIAX established a fresh CL for a 6th consecutive session. While spreads have seen a bounce off recent lows they remain historically wide. SovEcon raised their Russian production forecast .6 mmt to 83.6 mmt, in line with the USDA at 83.5 mmt. They also raised their export forecast .4 mmt to 43.3 mmt, still well below the USDA at 46 mmt. Russia media reports farmers have so far harvested 50 mmt of grain. Late yesterday Pres. Trump threatened to impose tariffs and other measures against Russia if they do not start showing an increased effort to end the war with Ukraine in the next 10 days. Export sales tomorrow are expected to range from 12-25 mil. bu.

All charts are provided by The Hightower Report.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.