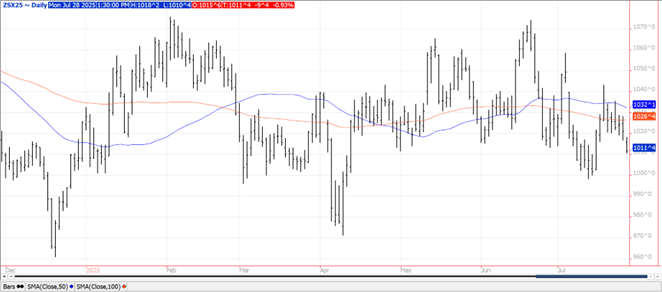

CORN

Prices were $.05-$.06 lower today closing near session lows. Spreads were mixed with nearby Sept/Dec widening to a new low at ($.20 ¾). Support for Dec-25 is at its contract low at $4.07 ½. The extreme heat that covers much of the nation’s midsection is expected to ease over the next 24-48 hours. Today’s highs will be in the upper 90’s perhaps even a few 100 degree readings as far north as SD and W. Iowa. By mid-week seasonally normal to below normal temperatures are expected with daily highs in the upper 70’s. Rains over the balance of the week are expected to be heaviest across Iowa, S. MN and E. NE. Export inspections jumped to 60 mil. bu., above expectations and above the 40 mil. bu. needed to reach the USDA forecast of 2.750 bil. bu. YTD inspections at 2.375 bil. are up 29% from YA vs. the USDA forecast of up 22%. Noted buyers last week were Japan with 24 mil. and Mexico with 17 mil. The USDA also announced the sale of 225k mt (9 mil. bu.) of 25/26 MY to Mexico and 229k mt to unknown. Most of the unknown sale was also for the 25/26 MY. Friday’s CFTC report showed money managers were net sellers of 2.6k contracts while index funds sold 1k. AgRural is reporting Brazil’s 2nd harvest has reached 68% as of late last week, well below the 91% pace from YA.

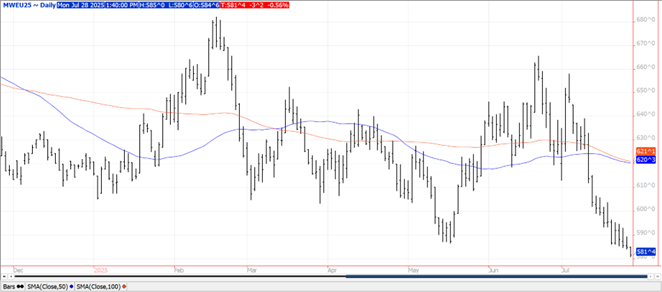

SOYBEANS

Prices are mostly lower across the complex with beans down $.08-$.10, meal was off $2-$3 while oil was a few ticks higher. Bean and meal spreads weakened while oil spreads were mixed. Aug-25 beans have slipped to a 3 ½ month low with next support at $9.82 ¾. Nov-25 beans slipped to its lowest level in nearly 2 weeks with next support at $9.98 ¼. Inside trade for Aug-25 oil as it consolidates just below the July high at 57.17. Aug-25 meal barely held support above its contract low at 264.50. Spot board crush margins jumped another $.04 to $2.16 per bu., the highest in a year. Bean oil share reached a fresh modern day high of 51.6%. New crop crush margins increased $.04 to $2.18 ½ bu. The US/EU reached a trade agreement yesterday that reduced tariffs on imports from the EU to 15%, half of what the Trump Administration threatened. Specifics on the sale of US Ag. goods are lacking. US Treasury Sec. Bessent met again today with his Chinese counterpart in Sweden to discuss trade. The most likely outcome is another 90 tariff truce which IMO is viewed as price negative, particularly for soybeans as large purchases of US Ag. goods are seemingly being kicked down the road. Still no Chinese soybean purchases on the books for the 25/26 MY. Markets seem to be gearing for a direct meeting between Pres. Trump and Chinese leader Xi sometime this fall. Export inspections at 15 mil. bu. were at the high end of expectations however below the 17 mil. needed to reach the USDA forecast of 1.865 bil. YTD inspections at 1.734 bil. are up 10% from YA, in line with the USDA forecast. Egypt was the largest taker at nearly 6 mil. bu. MM’s bought just over 21k contracts of soybeans, 12k oil and nearly 3.3k meal. As of last Tues. MM’s were still short 11k contracts of beans, 130k contracts of meal and long 55k contracts of oil. Over the weekend Argentina lowered their export taxes on soybeans to 26% from 33%. Soy products fell to 24.5% from 31% while grain export taxes were trimmed from 12% to 9.5%.

WHEAT

Prices finished mixed with Chicago and KC futures within a penny of unchanged in 2 sided trade. MIAX futures were down $.02-$.03. Spreads were also very little changed. Sept-25 CGO held support just above this month’s low at $5.32. New contract low for Sept-25 MIAX with consecutive lower closes. The US $$$ index was sharply higher surging thru its 50 day MA resistance. Export inspections slipped to 11 mil. bu., below expectations and below the 16 mil. needed to reach the USDA forecast. YTD inspections at 122 mil. bu. are up 6% from YA, in line with the USDA forecast. MM’s last week were net buyers of 8.4k contracts of CGO, 4k contracts of KC while sellers of 10.3k contracts of MIAX.

All charts are provided by The Hightower Report.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.