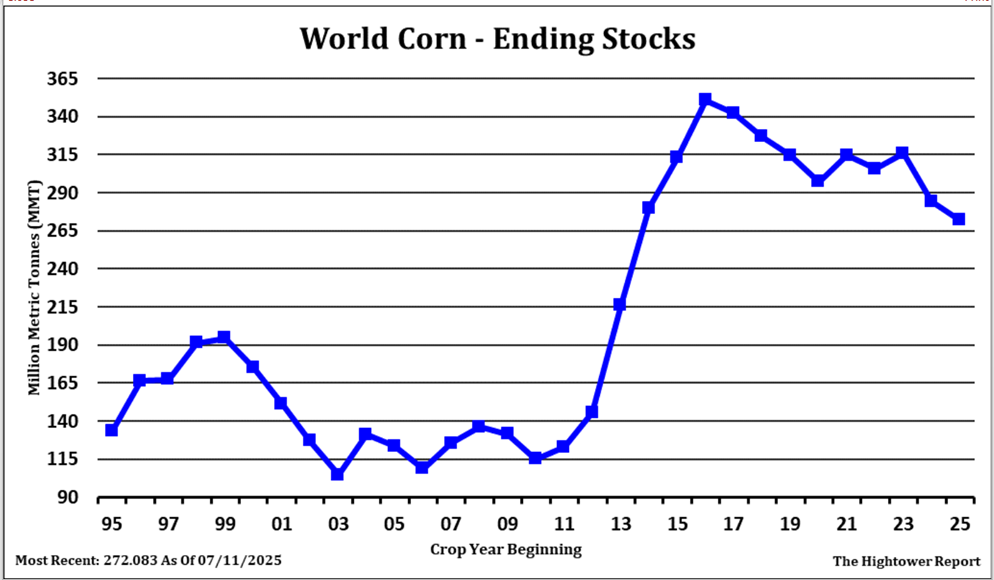

CORN

CU ended near 3.99. USDA estimates World 24/25 corn crop at 1,225 mmt vs 1,230 the previous year. US crop is estimated at 377 mmt vs 389 the previous year. Brazil crop is 132 mmt vs 119 in 23/24. Argentina 50 mmt vs 51. Ukraine 26.8 mmt vs 32.5. USDA estimates World 25/26 corn crop at 1,263 mmt. US crop is estimated at 398 mmt. Brazil crop is 131 mmt. Argentina 53 mmt. Ukraine 30.5. USDA estimates World 25/26 corn end stocks at 272 mmt vs 284 in 24/25. CU is now below all key moving averages. Open interest continue to drop. Volume has also slowed. Some look for CZ to test 3.40 as harvest low as long as US Midwest weather remains favorable.

SOYBEANS

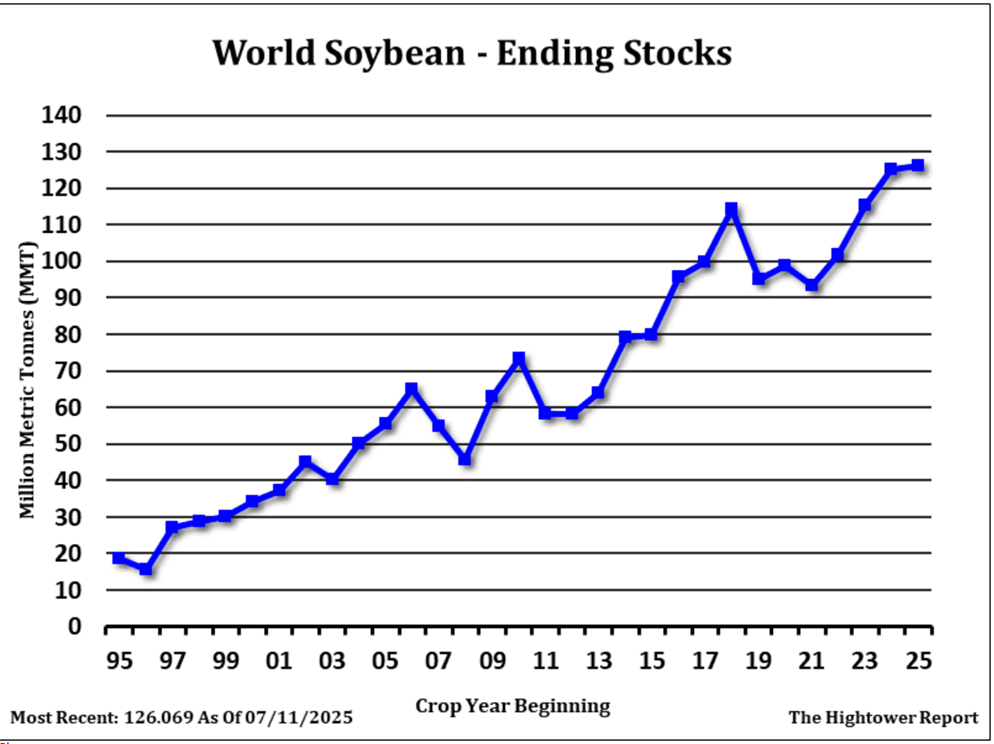

SU ended near 10.08. Soymeal is near 278 on short covering. World soymeal basis levels are lower on too much supply. Soyoil ended lower on liquidation of long soyoil short soymeal spreads. US farmers remain reluctant sellers of new crop soybeans. USDA estimates World 24/25 soybean crop at 401 mmt vs 376 the previous year. US crop is estimated at 118 mmt vs 113 the previous year. Brazil crop is 169 mmt vs 154 in 23/24. Argentina 49.9 mmt vs 48.2. USDA estimates World 25/26 soybean crop at 427 mmt. US crop is estimated at 118 mmt. Brazil crop is 175 mmt. Argentina 48.5 mmt. USDA estimates World 25/26 soybean end stocks at 126 mmt vs 125 in 24/25. SU is now below all key moving averages. Open interest continue to increase. Volume has increased over the last few trading days.

WHEAT

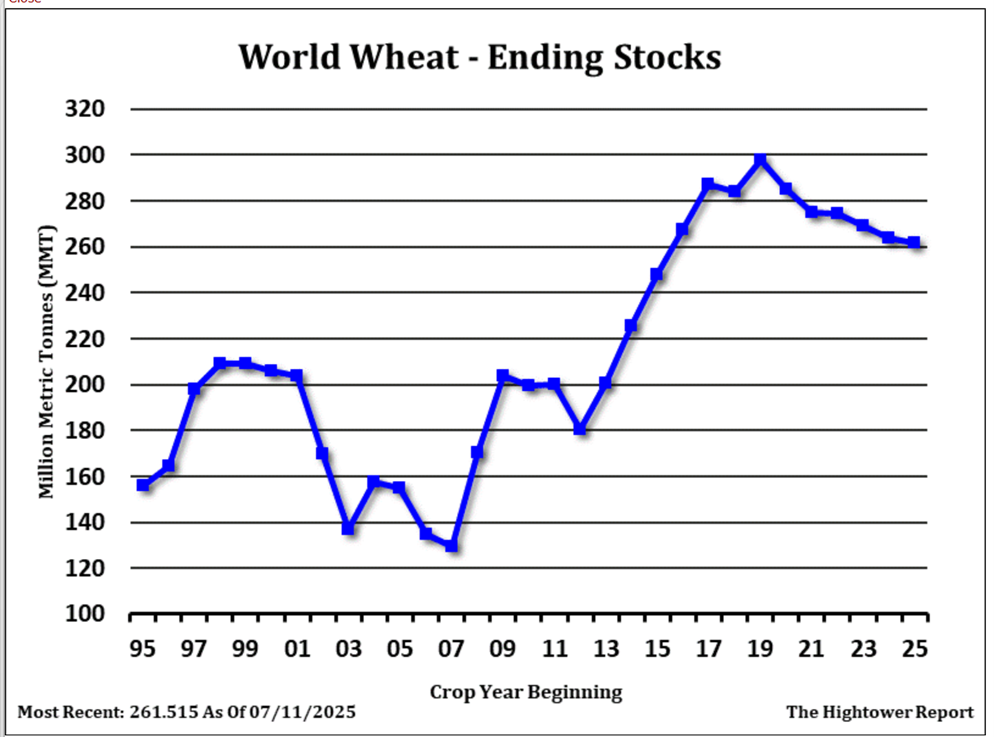

WU ended near 5.92 in mostly range bound trade and increase in open interest. KWU ended near 5.33. MWU ended near 5.91. USDA estimates World 25/26 wheat crop at 808 mmt vs 800 the previous year. US crop is estimated at 52 mmt vs 53 the previous year. China crop is 142 mmt vs 140 ly. EU crop is 137 mt vs 122 ly. Russia crop is 83.5 mmt vs 81.6 ly. USDA estimates World 25/26 wheat end stocks at 261 mmt vs 263 in 24/25. China end stocks are 124 mmt. WU is back above the 20 day moving average. Open interest continue to increase. Volume has increased over the last few trading days. Wheat futures remain in a carry and near the higher end of trading range.

All charts are provided by The Hightower Report.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.