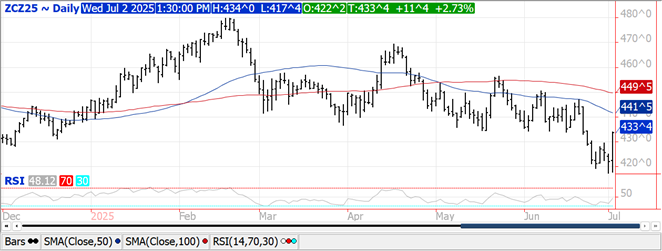

CORN

Prices shook off early weakness to close $.10-$.12 higher. Nearby spreads weakened while new crop spreads firmed a touch. Yesterday StoneX raised their production forecast 2.1 mmt to 136.1 mmt. SA consulting group Celeres raised their production forecast 12.2 mmt to 147.6 mmt. The highest est. however belongs to AgroConsults who raised their est. to 150 mmt LW. I expect the USDA to resume raising their forecast in next Fri. July WASDE report, likely somewhere between 3-5 mmt. Ethanol production slipped to 316 mil. gallons, down from 318 mil. the previous week, however up 1% YOY. Production was slightly below expectations, however above the pace needed to reach the USDA corn usage est. for a 5th consecutive week. There was 107 mil. bu. of corn used in the production process, or 15.35 mil. bu. per day, above the 15.1 needed to reach the USDA forecast of 5.50 bil. Ethanol stocks slipped to 24.1 mil. barrels, at the low end of expectations and just above the 23.6 mb YA. Implied gasoline usage plunged 11% LW to 8.64 tbd and was down 8% YOY.

SOYBEANS

Prices surged higher across the complex today. Beans were $.20-$.26 higher led by old crop. Both Aug-25 and Nov-25 contracts surged thru their respective 50 and 100 day MA’s. Next resistance for Nov-25 is the June high just under $10.75. Meal was up $3 after making fresh contract lows in Aug-25 futures for an 8th consecutive session. Futures also carved out a key reversal day, closing above yesterday’s high. Bean oil was up 130-140 points with next resistance for Aug-25 at 55.98. Spot board crush margins slipped $.04 ½ to $1.54 ½ bu. with bean oil PV inching up to 50.3%, nearing the all-time high of 51%. New crop crush margins improved $.01 ½ to $1.97 ½ bu. Prices across the Ag. space surged on speculative buying driven by hopes Pres. Trump may announce a trade deal with China that involves US agricultural products. The Pres. is scheduled to deliver a speech to Rural America in Des Moines at 7:30 PM on the Eve of Independence Day. A trade deal with Vietnam has been reached. US products can enter Vietnam duty free while the US will charge a 20% tariff on imports from Vietnam, well below the 46% reciprocal tariff announced in April. US weather remains non-threatening as temperatures roll back to normal levels in week 2 of the outlook. Census crush in May at 203.7 mil. bu. was slightly below expectations. Total crush in the first 3 Qtr’s of the 24/25 MY have reached 1.845 bil. bu., up 5.9% from YA in line with the USDA. Bean oil stocks slipped 5% to 1.876 bil. lbs. in line with expectations and down 14% YOY. If the BBB passes the House look for the USDA to start shifting bean oil usage away from exports and back to domestic usage for biofuel production. This shift likely to be mostly felt in new crop 25/26. Brazil’s bean exports in June are expected to have reached 13.93 mmt, slightly above their previous est. and a new record high for the month. Expect a slowdown in Argentine farmer sales after a glut of selling last month ahead of the higher their export tax hike which began July 1st. Their export tax on soybeans rose to 33%, up from 26% while product taxes rose from 24.5% to 31%. Export sales tomorrow are expected to range from 10-30 mil. bu. of beans, 100-600k tons of meal and -10 – 25k tons of oil.

WHEAT

Prices were $.12-$.15 higher across all 3 classes today joining in on the bullish enthusiasm with otherwise little fresh news. Sept-25 CGO has jumped to a 1 week high with next resistance at the 100 day MA at $5.71. Spreads in CGO firmed while holding steady in KC. Wheat areas in Argentina show better prospects for rain in week 2 of the outlook. Relief from extreme heat in W. Europe has been slow to materialize, with drought relief even slower. The extreme heat will gradually shift in SE Europe while likely to last for at least a week. Better prospects for rain in Europe the first half of next week however coverage will be scattered. Monday’s lower harvested acreage forecast from the USDA for winter wheat should provide underlying support to both CGO and KC futures. The CME announced they completed its 1st physical delivery cycle for Hard Red Spring futures with 182 contracts delivered earlier this week. The Trump Administration announced they were with holding key Patriot defense missiles from Ukraine in an effort to beef up domestic inventories. Another sign of US weakening support of Ukraine as it attempts to fend off Russia. Export sales tomorrow are expected to range from 8–20 mil. bu.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.