CORN

Prices were $.02-$.03 lower in choppy 2 sided trade. Spreads weakened with a new low for Sept/Dec at -$.19 ½. Key overhead resistance for Dec-25 rests at the gap from early last week at $4.30. Late yesterday Pres. Trump stated on social media that Coca-Cola agreed to use cane sugar in its beverages in the US. Coca-Cola didn’t confirm nor deny Trumps statement. It’s estimated HFCS production accounts for just over 400 mil. bu. of corn usage in the US for the 24/25 MY. This has been on a slow decline for over a decade. Coca-Cola’s usage alone likely accounting for nearly 90 mil. bu. Export sales at 26 mil. bu. were well below expectations. Old crop sales at 4 mil. were a MY low with commitments now at 2.735 bil. still up 27% from YA, vs. the revised USDA forecast of up 22%. New crop sales at 236 mil. bu. while up 45% from YA, they represent 9% of the USDA forecast, below the historical average for mid-July of 13%. US corn area in drought slipped another 3% to only 9%. Some talk of corn pollination issues across portions of the Midwest as due to lack of nighttime cooling. Argentine harvest advanced 8.5% in the past week to 79% according to the BAGE.

SOYBEANS

A late session recovery in soybean meal enabled prices to close higher across the complex. Beans were $.06-$.08 higher, meal was up less than $1 while oil has surged $.014 per lbs. Bean and meal spreads were mixed while oil spreads weakened. Aug-25 beans jumped out to a 1 week high with next resistance at the 100 day MA at 10.37 ½. Aug-25 oil has surged to its highest level since Sept-23. Inside trade for Aug-25 meal. Spot board crush margins jumped $.08 to $1.88 bu., with bean oil PV at a modern day high just over 51%. Rumors that trade negotiations with China are going well seem to be providing underlying support. Weather wise a seasonally cool pattern has settled in across much of the northern half of the Midwest. It won’t last too long however as heat in the S. Plains begins to build across the WCB this weekend and into the central Midwest by early next week. Temperature readings of 100-105 will be common for the S. Plains with low to mid 90’s across much of the central and ECB by the middle of next week. Export sales at 30 mil. bu. were in line with expectations. Old crop commitments at 1.861 bil. are up 12% from YA vs. the revised USDA forecast of up 10%. New crop sales at 87 mil. bu. represent only 5% of the USDA forecast, vs. the historical average of 14%. Soybean meal sales at 531k tons (357k–2024/25 MY, 174k–25/26) were in line with expectations. Old crop commitments are up 13.5% from YA, vs. USDA up 8%. Bean oil sales at 8k tons (17.4 mil. lbs) were in line with expectations. YTD commitments at 2.380 bil. lbs. represent 91.5% of the USDA forecast. ABIOVE held their Brazilian production forecast steady at 169.7 mmt, however raised their crush forecast .3 mmt to 57.8 mmt, vs. the USDA forecast of 57 mmt. The increase is crush was driven by the increased mandatory biodiesel blend rated from 14% to 15% starting Aug. 1st. The Rosario Grain Exchange raised their Argentine production forecast 1 mmt to 49.5 mmt just below the USDA est. at 49.9 mmt.

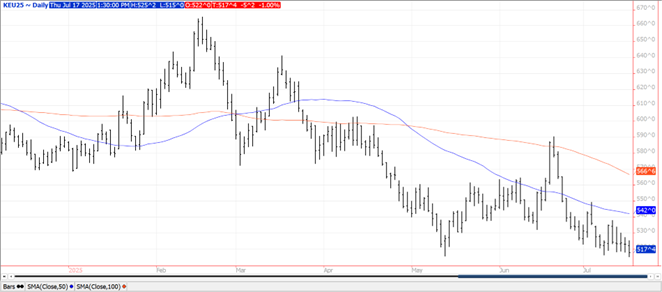

WHEAT

Prices were $.04-$.08 lower across the 3 classes today. Wheat was being pressured by comments from Russia they intend to expand their grain exports into Asia, ie lower offers. Fresh 2 month low for Sept-25 CGO and MIEX futures. New contract low for Sept-25 KC. Winter harvest is wrapping up across the S. Plains Late season dryness likely to trim white winter production in the PNW. The RGE lowered their Argentine production forecast 700k mt to 20 mmt. The BAGE reports planting progress advanced only 2% LW to 93%. Export sales at 18 mil. bu. were in line with expectations. YTD commitments at 303 mil. bu. are the highest in 5 years and up 7% from YA, vs. the revised USDA forecast of up 3%. Commitments represent 36% of the USDA forecast, above the historical average of 33%. YTD by class sales vs. the USDA forecast are HRW up 68% vs. USDA up 26%, SRW up 20% vs. USDA up 3%, HRS down 13% vs. USDA down 4%, and white down 36% vs. down 14%.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.