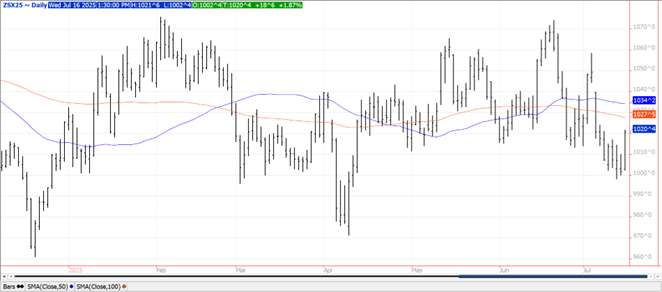

CORN

Prices were $.04 higher in choppy 2 sided trade drawing support from the surge in soybeans. While spreads were little changed, Sept/Dec did widen to a new low at -$.19. Key overhead resistance for Dec-25 rests at the gap from early last week at $4.30. Next resistance is at the 50 day MA at $4.36. Speculative traders have been net buyers 5 out of the past 6 sessions cutting their short position back to under 180k contracts. O.I. yesterday was down over 21k contracts. Ethanol production inched up to 1,087 tbd, or 320 mil. gallons, up from 319 mil. the previous week, however down 2% YOY. Production was at or above the pace needed to reach the USDA corn usage est. for a 7th consecutive week. There was 108.5 mil. bu. of corn used in the production process, or 15.5 mil. bu. per day, above the 15.3 needed to reach the USDA forecast of 5.50 bil. Ethanol stocks slipped to 23.6 mil. barrels, the lowest since Dec-24 however just above the 23.2 mb YA. Implied gasoline usage last week fell 7.3% to only 8.489 tbd, and was down 3.3% YOY. Tomorrow’s export sales are expected to remain strong at 35-80 mil. bu. old and new combined. Brazil’s 2nd crop harvest is running at a slower than normal pace resulting in Brazilian basis remaining seasonally elevated. This has slowed the shift in corn demand to SA benefiting US demand. Brazilian exports are expected to reach 4.6 mmt in July, while above the 3.6 mmt from July YA they are expected to remain below the record high for the month at 5.9 mmt.

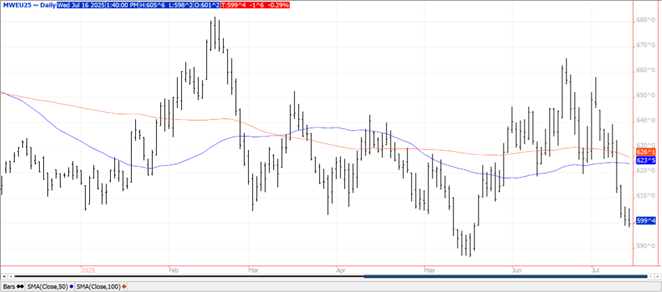

SOYBEANS

Prices were higher across the complex with beans up $.17-$.19 closing near session highs. Meal was up $3-$4 while oil was 25 points higher. Bean and oil spreads were mixed while meal spreads weakened. The US $$$ index collapsed midday following reports Pres. Trump planned on firing Federal Reserve Chair Powell soon. Shortly thereafter Trump acknowledged bringing up the possibility of Powell being fired, however claimed he hasn’t drafted up the necessary documentation. Trump has become increasingly vocal over his frustration with the Fed’s refusal to lower interest rates. US weather remains favorable into the end of July with much of the nation’s midsection seeing rains over the next week. Aug-25 is back above $10 with near term resistance at $10.16. Nov-25 beans also rejected trade below $10 with next resistance at the 100 day MA at $10.27 ½. Inside trade for Aug-25 oil with major resistance just below $.56 lb. Spot meal didn’t make a new low today, a rarity in this environment. US Gulf basis has jumped $.10-$.15 at midday. The USDA did announce the sale of 120k mt (4.4 mil. bu.) to an unknown buyer for the 25/26 MY. Spot board crush margins pulled back $.09 today to $1.80 bu. with bean oil PV slipping to 50.5%. New crop margins fell $.08 ½ to $2.04 ½. Australia’s Govt. claims to be close to a deal to ship 5 cargoes of canola to China, their first shipments since 2020. Brazilian exports are expected to reach 12.2 mmt in July, down from 13.9 in June and below the 13.4 mmt from July-24. US export sales tomorrow are expected to range from 12-36 mil. bu. of beans, 200-700k mt of meal, and 0-20k tons of oil.

WHEAT

Prices ranged from down $.01-$.02 in KC and MIAX to $.03 higher in CGO. Sept-25 CGO traded to a 2 month low ahead of the midday recovery. Sept-25 KC has held above LW’s low at $5.16, which is just above the contract low at $5.15 ½. Sept-25 MIAX closed below $6.00 bu. for the first time in 2 months. It appears most of the Algerian purchase of just over 1 mmt of wheat was sourced from the Black Sea region, with some from the Baltic Sea area. The Ave. price paid at near $256/ton CF was about $12 higher than their last purchase in mid-June. Yesterday IKAR lowered their Russian wheat production forecast 84 mmt, today SovEcon raised their Russian wheat production forecast .6 mmt to 83.6, both are closing in on the USDA est. at 83.5 mmt. Tomorrow’s export sales are expected to range from 10-26 mil. bu.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.