CORN

Prices were $.02 higher today largely in sympathy with the higher soybean prices. Spreads finished little changed. Friday’s CFTC report showed money managers were net buyers of nearly 7,500 contracts of corn last week cutting their short position to just below 174k contracts. This was more than offset by index funds being net sellers of just over 8.3k contracts. APK-Inform raised their Ukraine corn production forecast 2.6 mmt to 27.5 mmt, still well below the USDA forecast of 30.5 mmt. Their export forecast however was raised to 23.5 mmt, in line with the USDA at 24 mmt. AgRural reports Brazil’s 2nd crop harvest advanced to 88% complete as of late last week, below the YA pace of 97%. US export inspections at 59 mil. bu. were above expectations and above the 30 mil. bu. needed to reach the USDA forecast of 2.750 bil. bu. YTD inspections at 2.485 bil. are up 29% from YA vs. the USDA forecast of up 22%. Noted buyers were Mexico – 18 mil., Japan 10 mil. and South Korea – 8 mil.

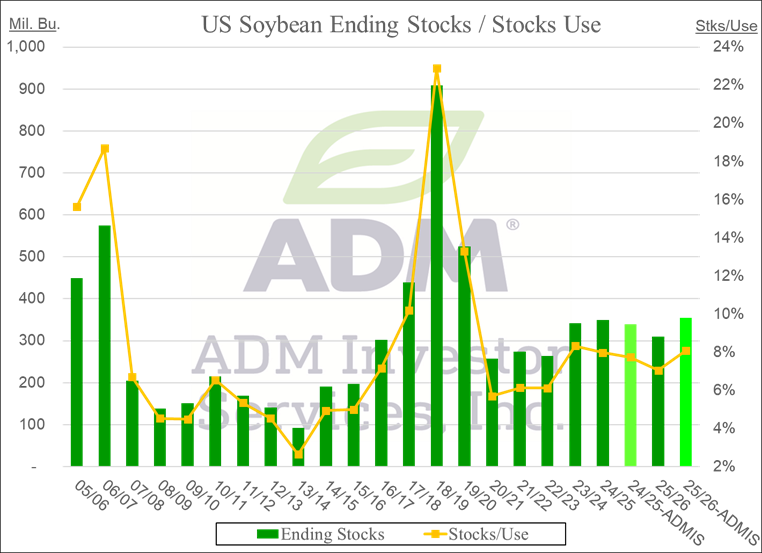

SOYBEANS

Prices were higher to sharply higher across the complex today. Beans were $.20-$.24 higher, meal was up $4-$5 while bean oil rebounded 45-50 points. Nov-25 beans jumped out to their highest level in 2 weeks. The 50 and 100 day MA resistance rests above the market between $10.22 ½ and $10.24 ½. Sept-25 meal spiked to a 5 week high while briefly piercing its 50 day MA at $282.70. Inside trade for Sept-25 oil as it hovers near its 50 day MA at 52.96. Strength was attributed to Pres. Trump’s post on Truth Social claiming that China is worried about its shortage of soybeans. The Pres. called on China to quadruple their purchases of US soybeans which would substantially reduce their trade deficit with the US. Adding “rapid service will be provided ! Thank you Pres. Xi.” At the moment China has exactly zero bu. of soybeans on the books for the 25/26 MY from the US. 4 times zero is still zero. A year ago China just started buying US beans having only 20 mil. bu. of new crop by early Aug. For all of the 24/25 MY China has imported 840 mil. bu., the lowest since 2019/20. Quadrupling that figure would take Chinese purchases to over 3.350 bil. bu. nearly 78% of this year’s US crop, so that’s not going to happen. Spot board crush margins sank $.09 ½ to $2.11 bu. with bean oil PV slipping to 48.6%. New crop margins fell $.07 to $2.10 ½ bu. MM’s were net seller of nearly 30k contracts of soybeans, extending their short position to 66k contracts, the largest since the end of 2024. They were also sellers of nearly 12k bean oil and while only net sellers of a couple hundred contracts of meal, it did extend their short position to a new record 133,592 contracts. Soybean inspections at 19 mil. bu. were above expectations and above the 12 mil. needed to reach the USDA forecast of 1.865 bil. YTD inspections at 1.777 bil. are up 11.5% from YA, vs. the USDA forecast of up 10%.

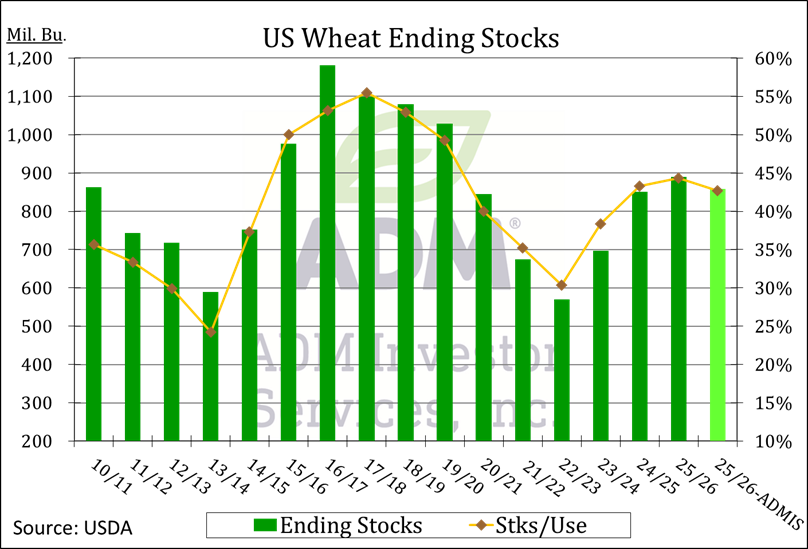

WHEAT

Prices were mixed and within $.01 of unchanged across the 3 classes. MM’s were net sellers in all classes of wheat last week with over 15k CGO, nearly 10K KC and 5k MIAX. Their net short position across the 3 classes jumped back out to 160k contracts, a 2 month high. Russian wheat exports slowed in July to only 1.78 mmt, down from 2.8 mmt YA. Shipments are expected to pick up in Aug. to 3.55 mmt, however still below the 5.65 mmt from YA. US export inspections at 13 mil. bu. were at the low end of expectations and below the 16 mil. needed to reach the USDA forecast. YTD inspections at 160 mil. bu. are up 2% from YA, in line with the USDA forecast. Ukraine’s wheat harvest has reached 15 mmt, well below the 21 mmt gathered YA. Grain exports as since July 1st at only 2.1 mmt are well below the 4.7 mmt from YA. Wheat exports at 1 mmt are down 49% YOY. Look for US spring wheat ratings to hold steady at 48% G/E. Harvest is expected to have reached 14%. WW harvest is expected to have reached 92%.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.