CORN

Prices were $.02-$.04 ½ in 2 sided trade. Spreads also weakened. Prices seem to have turned range bound. US weather remains non-threatening into Mid-August. The Midwest will experience normal to below normal temperatures thru the middle part of next week while also seeing a reprieve from some of the heavy rainfall. The upside is limited with growing production prospects here in the US and Brazil. Support below the market stems from strong export demand as US prices remain at a $5-$10 per ton discount to Brazil thru Nov-25 despite record production from their 2nd harvest. Until this dynamic changes US demand will remain strong. The USDA announced 2 separate sales to an unknown buyer for the 2025/26 MY, 125k (5 mil. bu.) and 227.2 mmt (9 mil. bu.). The BAGE reports Argentine harvest advanced 4% to 88% while keeping their production est. unchanged at 49 mmt vs. the USDA forecast at 50 mmt. Corn used for the production of ethanol in June reached 448 mil. bu., at the low end of expectations. In addition last month’s usage figure was revised down by nearly 2 mil. bu. to 446 mil. Cumulative usage over the first 10 months of the 24/25 MY at 4.523 are up less than 1% from YA. To reach the current USDA forecast of 5.50 bil. bu. usage in July/Aug will need to reach 977 mil. bu. up 1.4% from YA.

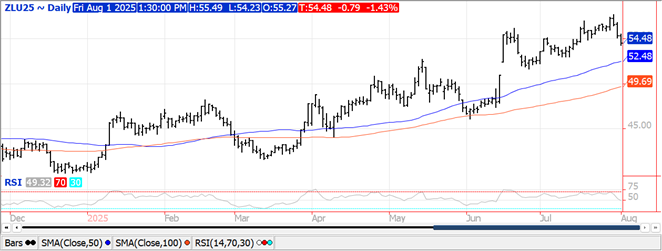

SOYBEANS

Prices were mixed in 2 sided trade. Soybeans were within a penny of unchanged, meal jumped $4-$6 while oil was down another 80-90 points. Bean spreads were flat while meal firmed and oil spreads were mixed. Deliveries jumped to 408 contract of beans, down to only 3 contract of oil while meal also fell, down to 629 contracts. Sept beans fell to a fresh 7 ½ month low overnight before bouncing. Fresh 3 ½ month low for Nov-25 beans. Soybean meal likely experiencing some short covering ahead of today’s CFTC report which will likely show a record large short position by MM’s. Spot board crush margins improved another $.03 to $2.28 ½ bu., the highest since Nov-23, while bean oil PV slid back to 50.6%, nearly 2% off the midweek high. As promised Pres. Trump revealed his sweeping list of reciprocal tariffs late yesterday however pushed back their implementation to Aug. 7th. US equity markets sold off following a much weaker than expected US jobs report. The US economy added 73k jobs in July, below expectations of 100k however combined job growth in June and May were revised down by 258k. Yesterday’s EIA combined biodiesel and RD production rose 15% in May-25 to 408 mil. gallons and was up 3.6% YOY. Soybean oil usage rose 23.6% to 1.025 bil. lbs., the highest since Dec-24 as the market grew increasingly confident the Trump Admin. would support biofuels produced from domestic feedstock. As a feedstock, bean oil usage grew to 35%, the highest since Nov-24. June-25 soybean crush at 197 mil. bu. was in line with expectations and a record high for the month. YTD crush at 2.042 bil. bu. is up 6% from YA, vs. the USDA forecast of up 5.8%. To reach the current USDA est. of 2.420 bil. bu. crush will need to reach 378 mil. bu. in July/Aug, up from 361 mil. YA. With the recent surge in crush margins this should be attained. Oil stocks increased to 1.895 bil. lbs., above expectations, which helps explain the recent price pullback.

WHEAT

Prices ranged from $.04-$.07 lower across the 3 classes today. New CL for spot Sept-25 CGO. New CL for an 8th consecutive session for Sept-25 MIAX. Next support rests at the Mch-25 low of $5.64 ½ on the weekly chart. The BAGE reports Argentine plantings have reached 98% while conditions improved 10% to 61% G/E, well above the 31% G/E from YA. SovEcon slashed their Ukraine production forecast 2.8 mmt to 19.8 mmt, now below the USDA est. of 22 mmt. They see average yields the lowest since 2019. They also lowered their Russian production forecast .3 mmt to 83.3 mmt citing weaker yields in the south. Southern Ukraine and S. Russia will remain in a dryer than normal trend for at least another week. Dry conditions have enabled soft wheat harvest in France to reach 89%, well above the YA pace of 63% and the historical average of 78%.

All charts are provided by The Hightower Report.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.