CORN

Prices were $.02 ½ – $.04 ½ lower today with spot Sept-25 carving out a new contract low. Spreads also weakened ahead of FND on Thursday. Sept/Dec widened to a new low at ($.22 1/2). Last year Sept/Dec bottomed out at ($.26 ½) in late Aug. Support for Dec-25 is at its contract low at $4.07 ½. US weather remains non-threatening into early August. The extreme heat that’s across the nation’s midsection will ease over the next 24 hours compressing the much above normal temperatures to the deep south. By late this week seasonally normal to below normal temperatures are expected with daily highs in the upper 70’s.Crop ratings slipped 1% to 73% G/E, in line with expectations. Conditions improved in 10 states while declining in 8. Overall ratings remain the highest since 2016. My crop condition model is suggesting an average US yield of 185.3 bpa, well above the USDA at 181 bpa. 76% of the crop is silking, while 26% is in the dough stage, all in line with recent history. With the recent reduction in their export tax, Argentina is expected to export 24.7 mt of corn to Vietnam. Earlier today wire service incorrectly reported the sale was to China. EU corn exports thru July 27th at 555.4k mt are down 74% YOY. Tomorrow’s EIA report is expected to show ethanol production range from 314-316 mil. gallons, down from 317 mil. the previous week. Expectations for higher production both here in the US and in Brazil will continue to limit upside price opportunities.

SOYBEANS

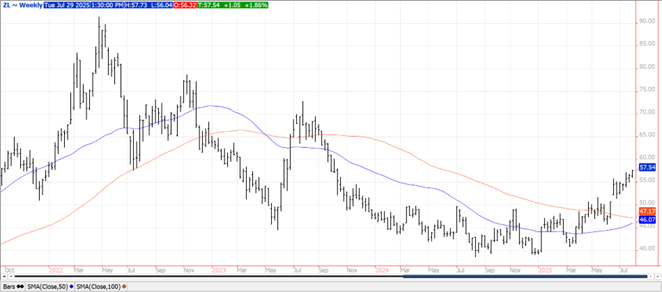

Prices are mostly lower across the complex with beans down $.02-$.07, meal was off another $3 while oil surged into new highs late, closing 75-100 points higher. Bean and meal spreads weakened while oil spreads are firm. The Aug/Sept bean spread has gone from a $.27 premium in early June to a new low today at an $.08 discount. Aug-25 beans slipped to its lowest level since Dec-24. Next support is its CL at $9.64. Support for Nov-25 beans is at its July low at $9.98 ¼. Spot bean oil jumped to its highest level since Oct-23 on the spot weekly chart. New CL and fresh 9 year low for spot meal. Spot board crush margins surged another $.11 today to $2.27 bu., it highest level since Nov-23. Bean oil PV jumped out to a new modern day high at 52.4%. New crop margins improved $.05 to $2.23 ½ bu. Rains over the balance of the week here in the US are expected to favor E. NE across much of Iowa, and along N. IL and N. IN. At midday US Treasury Sec. Bessent indicated his trade talks with Chinese representatives were constructive however Pres. Trump will have final say on whether the tariff truce will be extended for another 90 days from the current deadline of Aug. 12th. This week’s talks didn’t discuss a potential Trump/Xi meeting however they have been expecting to meet in late Oct. in S. Korea. Wire services are reporting that record Chinese soybean imports so far in 2025 combined with recent soybean meal purchases from Argentina have led to a supply glut, suggesting imports from the US will be slow to materialize. So far no US beans have been booked by China for the 25/26 MY. China also reportedly sold 150k mt of bean oil to India for Sept-Dec. shipment at roughly a $20 per ton discount to SA offers. US soybean conditions improved 2% to 70% G/E, better than expectations. Conditions improved in 10 states while declining in 8. Ratings are the highest since 2020. Current conditions would suggest and average yield at just over 53 bpa. Vs. the USDA forecast of 52.5 bpa. 76% of the crop is blooming matching the 5-year Ave. and just above the 75% from YA. 41% of the crop is setting pods, YA and 5-year Ave. of 42%

WHEAT

Prices were lower across the 3 classes today ranging from $.04 lower in MIAX to $.09 lower in Chicago. Sept-25 CGO slipped to a fresh 2 ½ month low, next support is the CL at $5.21 ¼. Sept-25 KC held a test of its CL at $5.15. A 5th consecutive day of new contract lows for Sept-25 MIAX wheat. Jordan passed on purchasing wheat from any of the 6 offers in their recent 120k mt tender. EU soft wheat exports for the 25/26 MY thru July 27th at 803.3k mt are down 64% from YA sales at 2.25 mmt. Winter wheat harvest advanced 7% to 80%, just below the 5-year Ave. and YA pace of 81%. Spring wheat conditions fell 3% to 49% G/E, vs. expectations for little change. 92% of the crop is headed vs. 93% YA and the 5-year Ave. of 95%. Overall ratings are just below the 5-year Ave. Harvest is just underway at 1%.

All charts are provided by The Hightower Report.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.