MORNING AG OUTLOOK

Grains are quietly mixed. US Midwest should continue to see showers. Rains and normal temps into the first week of August could suggest near record US corn and soybean yields. Supply driven bear market continues. USD is higher. Crude is higher. Gold is higher and waiting news on tariff negotiations, US Fed rate decision and US nonfarm payroll index. US stocks are higher.

SOYBEANS

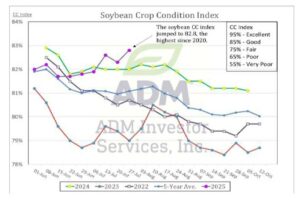

SU is near 9.91. SX-SF spread widening out to -19. Dalian soybean, soymeal were lower. Palmoil and soyoil were higher. US soybeans are rated 70% good to excellent, up 2%. Illinois is 65%, up 5%, Iowa 82%, up 2%, Indiana 61%, up 1%, Minnesota 71%, down 4%, Nebraska 75%, up 3%, South Dakota 73%, unch, North Dakota 62%, up 5%, Missouri 78%, up 1%, Ohio 58%, up 2%, and Michigan 45%, down 3%. 76% of the US soybean crop are blooming and 41% are setting pods. US soybean exports are up 10 pct vs ly and in line with USDA est.

CORN

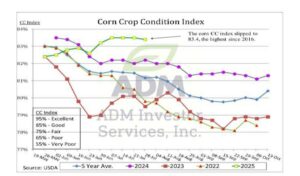

CU is near 3.93. CU-CZ is wide at -20. Dalian corn futures were lower. US corn is rated 73% good to excellent, down 1% on the week. Illinois is 71%, up 1%, Iowa 87%, up 1%, Indiana 71%, up 1%, Minnesota 74%, down 3%, Nebraska 77%, down 1%, South Dakota 76%, down 1%, North Dakota 71%, up 3%, Missouri 69%, unch, Ohio 62%, up 3%, and Michigan 49%, down 1%. 76% of the US corn crop is silking and 26% is in the dough stage US corn exports up 29 pct ly vs USDA up 22. US COF report was bullish.

WHEAT

WU is near 5.32. KWU is near 5.21. MWU is near 5.82. MWU are new lows. Nearby Chicago wheat futures could be in a 4.75-6.00 trading range. US spring wheat is rated 49% good to excellent, down 3% on the week. Idaho is 50%, down 6%, Minnesota 90%, up 3%, Montana 6%, down 1%, North Dakota 64%, down 3%, Oregon 26%, down 6%, South Dakota 56%, down 14%, and Washington 16%, down 5%. 92% of the US spring wheat crop is headed, 1% have been harvested. US winter wheat harvest is 80 pct. US wheat exports are up 6 pct vs ly and USDA up 3. Matif wheat futures higher due to lower Euro. Rains are improving Australia new crop outlook.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.