CORN

Prices were steady to $.01 higher today in choppy 2 sided trade. Spreads were mixed. Below normal temperatures are forecast for much of the central and WCB in week 2 of the outlook during what is likely to be the peak pollination stage for this year’s corn crop. Exports at 85 mil. bu. were above expectations. Old crop commitments at 2.731 bil. are up 28% from YA, vs. the USDA forecast of up 16%. Noted buyers were Mexico with 19 mil. old crop and 17 mil. new crop along with Japan, 17 mil. old and 12 mil. new crop.

SOYBEANS

Prices were higher across the complex. Beans ranged from $.03-$.06 higher with new crop the upside leader. Meal was up $2 while oil was 15-20 points higher. Bean and oil spreads were mixed while meal spreads weakened. Both old and new crop bean futures slipped to fresh 3 month lows on early weakness. Support for Aug-25 rests at $9.82 ¾. For now Nov-25 has held above the $10 level. My guess is the April lows will hold until we know more about late July/Aug weather. New contracts lows in Aug-25 meal for a 3rd consecutive session before rebounding. Spot board crush margins improved $.03 to $1.73 bu. while bean oil PV dipped to 49.6%. New crop margins improved $.01 to $2.02 bu. US weather remains favorable. Much of the nation’s midsection will see rainfall over the next week with heaviest amounts to favor the central Midwest. Soybean sales at 28 mil. bu. were in line with expectations. Old crop commitments at 1.853 bil. are up 12% from YA vs. the USDA forecast of up 9%.

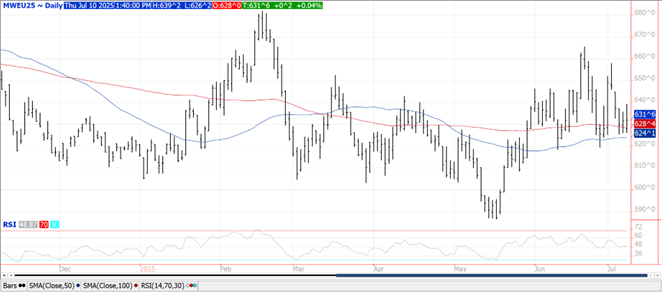

WHEAT

Prices ranged from steady to $.02 higher in MGEX while CGO and KC were up $.08-$.10. Sept-25 CGO closed back above its 50 day MA while also closing within a chart gap formed on Sunday nights lower open. Sept-25 MGEX rejected trade below its 100 day MA for a 3rd consecutive session. About the only trouble spot globally weather wise right now is W. Europe as this region continues to feel the effects of heat and drought stress on their summer crops. Exports at 21 mil. bu. were above expectations. YTD commitments at 285 mil. bu. are the highest in 5 years and up 9% from YA, vs. the USDA forecast of up 1%. Commitments represent 35% of the USDA forecast, above the historical average of 31%. By class sales were HRW – 7.4 mil., HRS – 6.5 mil., white – 4 mil. and SRW – 1.6 mil. Conab lowered their Brazilian forecast .4 mmt to 7.8 mmt, vs. the USDA est. of 8 mmt. Strategie Grain held their 25/26 EU soft wheat production forecast steady at 130.7 mmt, up 15% YOY. China lowered their wheat production forecast .1% to 138.2 mmt, below the USDA est. of 142 mmt. US winter wheat area in drought rose 2% to 26%, while spring wheat area in drought rose 6% to 35%.

Charts provided by QST.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.